21 Cryptocurrency Trading Tips I Wish I Knew Sooner

When it comes to cryptocurrency, I can safely say I was there from the beginning! From mining bitcoins on my Pentium 4 CPU racking up my parent’s power bill, losing thousands of now very valuable tokens on exchanges and now trading in the fourth crypto supercycle.

As said by every other blogger and YouTuber, “I am not a qualified financial advisor and borderline retarded at times. Trading cryptocurrencies poses considerable risk of financial loss. Please seek professional investment advice”.

This post was written in response to several friends and colleagues asking for advice on how to ‘start trading crypto’ and what to be careful of.

After over 15 years on the scene, millions of dollars transacted (some of it even profitable), tens of thousands of hours staring at graphs and countless failures, these are the tips that I wish I had known back at the start. This article for the most part is written in blood.

1. Don’t go in half-cocked! Research and have a plan

Before you spend your first dollar it is beyond essential that you have a plan on how you plan to shake the money out of the blockchain. Without a plan other traders will eat you alive and bleed you dry.

Without a trading plan, you are simply gambling and relying on luck

Me (Roman)

- Are you planning to be a HODLer and wait for your tokens to appreciate or actively Trade?

Both are completely different approaches and will heavily influence your approach. - What trading strategy do you plan to use?

- Day Trading: Trades lasting less than a day, often scalping the market.

- Swing Trading: Trading a short-medium-term trend for a tokens cycle

- Position: Holding a token for an extended time until it reaches a target price

- Passive or Active Trading

- Do you plan to use copy trading?

- Automated trading bots?

- Set realistic targets

Contrary to popular belief, buying into Bitcoin will not instantly make you a crypto-billionaire with 5 Lambo’s out the front! Realistically to trade crypto from scratch you need to treat it as a 6 month plus investment, with long term strategies such as HODL’ing requiring years.

One example is to make $50/day ($1000 month). - Start slow with a fixed budget

When starting, try it for a month with a modest but fixed budget to prove your strategy. This limits your losses, force you to be sensiable on your trades and will teach you valuable leasons. A sensiable starting budget is between $1-5k - Consider practice trading on a demo account

Many exchanges will allow you to create a demo trading account with ‘pretend’ money to allow you to learn their platform and practice your trading stratgey.

2. Have a risk management strategy

Risk management is fundamental for trading sustainably, retaining your profits and ties in with your trading strategy. Every trader and investor has had trades go bad and ‘Risk management’ with the crypto market being no different than any other type of trading. If anything worse due to its extreme volatility, questionable regulation and many tokens being backed on nothing but sentiment making it extremely unpredictable.

- Risk Amount: Percentage of your trading account balance you are willing to risk both per trade and per day. (ie 1% of total account balance to be traded per trade and 3% per day). It is important to have both a per trade and per day limit so you do not go chasing your losses in both a bad market or bad headspace.

- Risk Ratio: 3:1 (risk $1 to make $3) is a common way to quantify how you are going to trade.

It does not mean that you will make $3 every trade or for a single trade, but rather over a larger number of trades. Most traders do not win every trade or even 50%, closer to 40%.

Using the 3:1 ratio, you only need to win 34% of trades to still be profitable! - When do you pull a losing trade?

Where to set your stop loss and call it a day, this is one of the big parts of risk management and sometimes no matter what you do, everything is burning down. Your risk amount and risk ratio ultimately will ultimately help you set a stop loss. It is vital that this amount is agreed upon prior to entering the trade and you respect that decision.

In many cases it is is better to just kill a bad trade and either start a new trade at a different position or even change your direction on it in extreme cases!

3. Aggressive stop-losses will cost you money, not having one will cost you more

Stop losses are both a saviour and a curse which will blow your trades. A stop loss is designed to act as a safety mechanism to protect a trader from significant financial loss before a trade goes absolutely catastrophic (especially when using leverage).

It is normal for trades to sometimes temporarily go negative through normal market fluctuations and not being able to exactly time the exact bottom (or top) of the market when you first place them. This is particularly true for cryptocurrency which is extremely volatile and careful consideration must be taken to put the stop loss carefully with a plan.

If you set your stop loss overly aggressively, minor dips in the market will cause your trade to close at a loss or market manipulation techniques like flash crashes or stop loss hunting can lead to your trade ending unexpedently.

Common strategies for setting stop losses include:

- Percentage-Based Stop-Loss: Many traders use a percentage of the entry price to determine their stop-loss level. For example, some may choose to set their stop-loss at 5% or 10% below the entry price to limit potential losses while allowing room for market fluctuations.

- Support and Resistance Levels: Traders often place stop-loss orders just below support levels (for long positions) or above resistance levels (for short positions) to protect against potential breakdowns or breakouts.

- Moving Averages: Some traders use moving averages to determine stop-loss levels. For example, they may set their stop-loss just below a short-term moving average if they’re trading a bullish trend or above it if trading a bearish trend.

- Profit-to-Loss Ratio: The ultimate method is using your risk-reward ratio when placing stop-loss orders. For example, if you’re aiming for a 2:1 reward-to-risk ratio, your stop-loss should be placed at a distance that, if triggered, would result in a loss half the size of your potential profit target.

While nice in theory this often method may not always be the most appropriate method but rather influence if a particular trade is viable or safe.

4. Never Invest More than You Can Afford to Lose

^ I cannot stress this enough. You are genuinely several times more likely to lose money than make it as a beginner. There are absolutely no guarantees you will win a trade, become profitable or sustain yourself off trading.

When getting into trading or investments of any kind it should be treated as a secondary ‘disposable income’ that you do not need to rely on. Crypto-currency is incredibly speculative and unlike ‘safer’ investments like gold can drop to zero in an instant. Before you start trading you should already be financially secure and have a 6 month emergency fund you can quickly rely upon in unforeseen circumstances.

You should never get into debt to buy speculative investments (ie buy bitcoin or shares with a credit card). This is no different than withdrawing money to take to Las Vegas and gamble at the casino with.

It’s one thing to lose one money, but equally as bad to lose it and then owe it back to someone with interest!

Dave Ramsey has a caller who found them in this sticky situation in the below video where the individual borrowed $20,000 on interest-free credit card to get into an ETF which he expected to appreciate and make ‘free money’, however its value plummeted!

The only way to trade rationally and not go insane is to write off the amount mentally before you even start trading with it. If you make a profit excellent, if you make a loss that’s sad but life will go on with no consequences such as rent still being paid on time.

If you cannot afford to lose it, you cannot afford to invest it

Me (Roman)

Please do not put your last $1000 into crypto if you have no savings as a lottery ticket to get out of a bad place. Use it to by a new set of clothes to apply for a job, do a short course or Udemy subscription for a month instead to get ahead.

5. Don’t buy tokens just because they are cheap

A common trap many new entrants getting into trading make is buying cheap token with many decimal places expecting them to appreciate.

An example is, one day my 1,000,000 Shiba (USD$30) worth $0.00003 will become $1/each and I’ll be a millionaire!

Tokenomic Impossibilities

For this example it practically impossible as there are 549 trillion SHIB tokens in circulation and to become $1 the token would need to be worth $549 trillion (300 times bigger than Apple and more than six times the world’s annual GDP).

Buying into Dead Projects

The second common trap when people buy cheap tokens thinking they will are a hidden un-found gem is buying into dead projects that once shined but have been abandoned.

An example of this is KarenCoin which peaked during the last 2021 super-cycle but died shortly after once the markets cooled off. The token is now no longer listed on any exchanges, there is minimal trade volume, the sites website is down with domain up for sale and the team has presumably moved on with other things in their life.

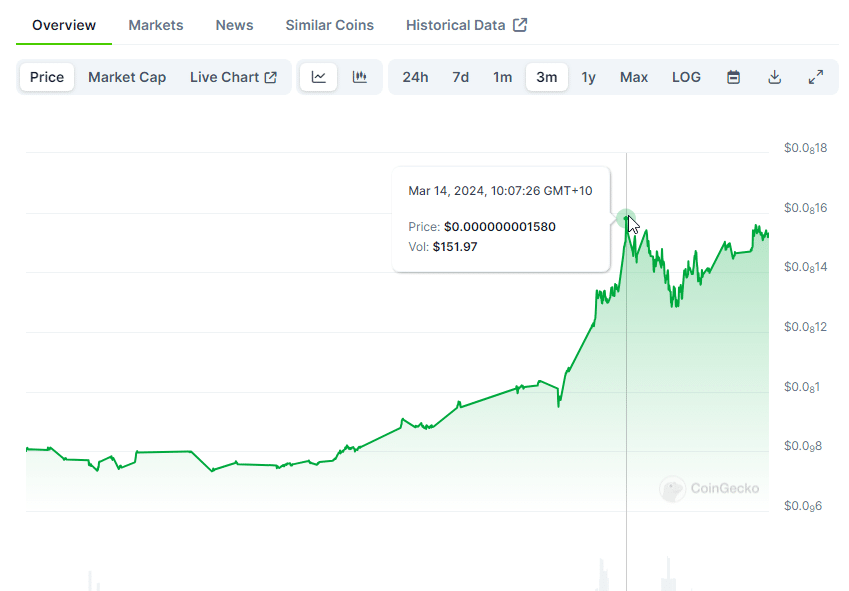

Despite this, in the recent run-up to the 2024 halving many years later people have found this token and started putting hundreds of dollars back into it. Viewed short term you’d almost see it as having a resurgence however the trading volume is so low individual transactions are moving the market!

Unfortunately at this stage, even if the token recovered slightly, existing holders who’s token values are essentially crypto-dust are likely to just immediately sell.

Before you buy, you need to do some research!

6. Understand what you are trading?

It sounds like a dumb point, but you’d be amazed how many people race into trading crypto tokens they have no idea about other than it has a funny name or cool logo! You don’t see Wall Street investors FOMO’ing into Nasdaq:YIBO (a random company) simply because the graph looks promisingly bullish this afternoon.

Not all projects and tokens are created equal and knowing what you are potentially getting into will give you the upper hand on if its a smart buy, its potential or something to steer clear of. YIBO by the way is a Chinese company called Planet Image International which exports printer toners by the way! Is it a good company, profitable market, been around for a while or even good trade I have no idea, but would be something any investor would want to know.

Knowledge is Power

Francis Bacon

Before getting into a new token I strongly, almost beg you to spend a few minutes going over the token and its project.

- When was it established: Getting into new projects with no track record can be risky, but be growth opportunities. More established tokens often have far higher market caps and trends. The same risks apply for older tokens which may just die off due to lack of innovation, given up on by team & community, poor tokenomics or newer more attractive tokens that accomplish the same goals

- Market Capitalisation: How many dollars are already invested in the token. Micro/Low market caps (sub 50 million) are volatile more likely to fail but are far more likely than to x10 overnight than Bitcoin which has a marketcap at the time of writing over $1.3+ trillion.

This is identical to how a start-up company can rapidly grow in value compared to a large enterprise like Microsoft. - Total & Circulating Supply

Knowing how many tokens exist & can be minted as well as how many are in circulating supply is important to estimate the realistic price action on a token-per-token basis. ie will SHIB ever reach $1 or even a cent. It is also important to know if all the tokens have been minted or if more can be created (inflationary) , if some are locked up (by who and what release schedule). - Trading Volume: How many tokens are being traded on a daily basis, give a indication of volatility and activity.

- Market Direction: Downwards, sideways, upwards

- Utility: Does the token have a utility like being able to execute smart contracts, currency for a platform or a meme coin

- Technology: Is this a native token or layer 2/3 token upon a network. what is the consensus mechanisms (ie Proof of Stake, Proof of Work)

- Tokenomic Considerations: Token burning, rewards system, distribution

- Community: How many holders, what the sentiment on the Telegram/social channels

- Whitepaper: Have you read it, is the team experienced, what is their deliverables and have they delivered, have they disclosed funding and team wallets

- Recent & Upcoming News: Do they have any exchange listing, controversies or announcements that may influence the token price

If you can answer all these questions on a token it is safe to say you will have a fair idea of what to expect before going to technical trading analysis side of things.

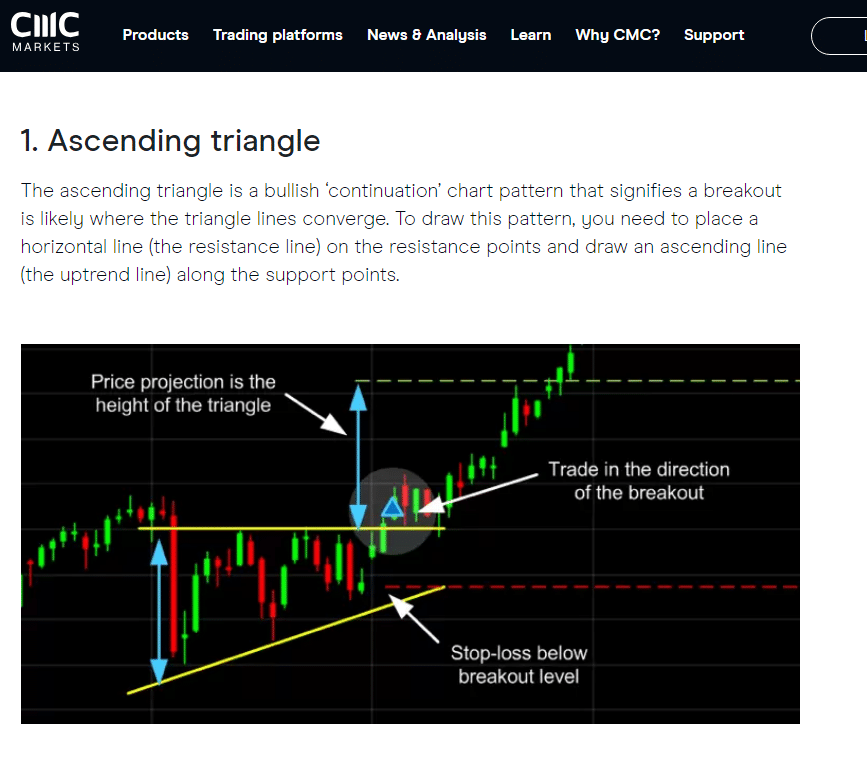

7. Learn How To Interpret Trading Indicators and Charts

Reading charts is essential skill in trading and provide crucial insights into market trends, patterns, and price movements. Understanding charts will help you identify entry and exit points (if they exist), assess risk, and make informed decisions which ultimately will improve the likelihood of successful trades.

The first step of being able to understand the chart is to identify the basic patterns, I’d strongly recommend reading and printing out in the colour the CMC Markets 11 Most Essential Stock Chart Patterns. While it won’t make you an expert over night it is a resource you can pull out and with a high degree of confidence.

Always zoom out on the graph and look at the big picture! I can’t stress this enough

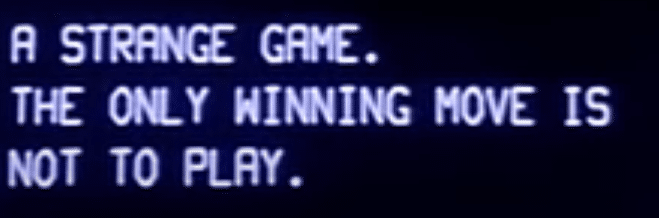

8. The best trade is often not to trade

In one way trading nuclear weapons is the same as trading crypto as the 1983 movie WarGames pointed out. The best and the only winning move is not to play.

There is no shame in calling the day off if the markets are not looking favourable for any of your strategies or the markets as a whole are looking turbulent.

While you may not make any money, at-least you won’t loose any!

9. There is no way faster way to lose incredible amounts of wealth than by using leverage

Leverage is a controversial and often misunderstood trading instrument which when used responsibly by experienced traders can help maximize there market position, allow better utilisation of capital and in some cases reduce risk.

Unfortunately, this tool is often promoted on exchanges and for inexperienced traders can get themself in very hairy situations very quickly. While it can make profits very quickly from very little, it can create horrific losses and liquidate your account in a split second if the token swings the other way.

My recommended advice for leverage is:

- Become experienced at trading spot first to refine your skills and strategy. If you cannot make money on spot, you will only amplify your losses when using leverage

- Don’t go crazy on leverage, often 3-5x is more than enough.

- Know your liquidation price and have a stop loss well above it to catch the trade if it goes bad

- Using 50x, 100x, leverage on random trades and with anything more than a few dollars will destroy you!

- Losses are not linear, towards the bottom of the range the losses spiral out of control

- All it tacks is one wick for a fraction of a second to wipe you out or trigger your stop losses

- Avoid having multiple trades open concurrently with leverage as the entire market could go down at the same time catching you out!

- Know the difference between Isolated margin vs. cross margin

- Do not have your entire wealth in the trading account in the unlucky event ou get margin-called

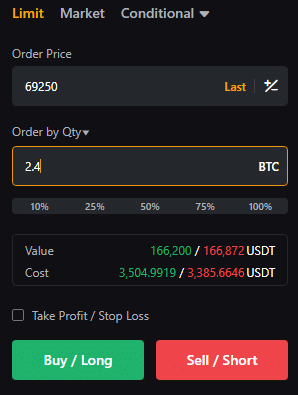

10. Use Dollar-Cost Averaging & Limit Orders To Get Into Positions

The best time to get into or out of a trade is almost never immediately at what-ever ‘Market Rate’ is when you click ‘buy now’. Always try to find a price point which the token will likely fall into over your time period be it days-weeks-months and set a ‘limit order’ in an attempt to buy it at a reduced price.

This is good practice when trading as it will maximise the amount you make per trade. If using leverage it is border-line essential as you want to buy at either the absolute top or bottom of the market depending on your position and to avoid the position becoming compromised or liquidated if it still keeps moving in the wrong direction.

Even if buying near immediately, you should still set a limit order as the actual ‘buy now’ price may fluctuate substantially than the last price indicated on the graph when you placed the order.

11. Know the difference between ‘realised’ and ‘unrealised P&L’

Knowing where you stand in the trade is vital, and P&L is vital to measure where you stand. It is broken down into 2 parts:

- Realized P&L: Components of the transaction which have been closed/confirmed, for example fees for opening the transaction. At the beginning of a trade this is normally negative and may continue to grow as more fees are added. It should not swing back and forth like Unrealised P&L.

- Unrealised P&L on the other hand are profits or losses which have not been finalised and subject to change at any second. Many people will try to weather a negative (loss) P&L to see if their position will improve.

You only lose or make money when you close the trade!

For the above example, it is important to note that the Realised P&L of the trade is ~$6, and while the trade improved its position and made $11. If the trade was to be closed, the closing fee of the trade would be another ~$6 leading to the total trade being a loss!

Have a limit on when to close a losing trade which is only getting worse, at some stage you will need to cut your loss’s and realise the loss! 🙁

12. Diversify your investment portfolio

Going all in and putting all your money on red in roulette is generally regarded as pretty foolish, the same is true for cryptocurrency. As solid as one particular investment option is, sometimes shit just happens and it crashes.

Back in the day I was a huge fan of Dash Coin, which when I first started was known as X-Coin, then Dark-Coin. At its peak the value of the token was over USD$1500, an incredible value when we months earlier were buying/mining them for dollars and had a very promising real world merchant utility on the horizon.

I was all in with a 6 figure amount as imagine how far it would scale with global usage like Paypal!

Out of the blue exchanges started de-listing the coin due to its optional ‘privacy’ ability, the price crashed and the project never really recovered. This was a major blow for me almost wiping me out and reinforced that I should not be putting all my eggs in one basket.

Similar major examples in recent for many tokens and networks include:

- XRP facing legal action by SEC resulting in delistings and poor price action

- Crash of Terra resulting in the collapse of Luna and the terraUSD stable coin

- Axie Infinity’s Ronin Bridge Hack stealing $650m of the networks assets

- Collapse of crypto lender Celsius and its CEL token holding $6.6 billion in liabilities

- Implosion on FTX exchange and FTT token

I have personally seen experienced traders and close friends who went all in with a particular project lose millions and their entire livelihood in a matter of minutes!

When building your cryptocurrency and investment portfolio you should take into account the following points:

- Do not rely on any single token, but rather a mix of ‘blue chip crypto’ (btc, eth, xrp, ada…) and spread of altcoins

- Do not rely on tokens from or backed by only one network, ie BNB

- Consider keeping some stablecoins in your portfolio (USDT, USDC, USDD) to stabilise it

- Do not keep all your assets on single exchange or platform

- Cryptocurrency should not be your only investment, consider other investment types such as shares, preciouses metals, expensive watches, collectable cards and go full boomer with real estate.

13. Be aware of your fees

As boring as this section is, it is often overlooked and sneaks up on you once you start performing larger more frequent trades. Be sure to price these into your profit calculations.

Common fees you should be aware of are:

- On ramping/Off ramping fees with bringing fiat into and off the platform.

- Spread:Difference between the bid (selling) and ask (buying) prices

- Trading Fees: Fees charged (percentage of the buy and sell total)

- Funding Fees: Fee paid every ~8 hours when trading perpetual

14. There is no ‘easy money’, only ‘easy loss’ and scams

There is no shortage of people trying to short-change you in crypto, their are no free lunches.

Anyone promising you free easy money is almost certainly a scam and anyone offering to help should be treated with the utmost suspicion.

Airdrops

From time to time projects will airdrop (send tokens) directly into your account. There are valid reasons for this such as replacing their token to a new contract, rewards for being a holder or as a form of mass marketing (dusting).

It is critical that you always research if a airdrop of legitimate and the process it will be carried out with. You should never interact with unknown tokens or NFT’s that you were not expecting or interacting without anyone or any site promising a airdrop.

Many scammers will ask you to send them your tokens and they will send you back the new token (which they never do) or ask you to click on a link to compromise your wallet.

Investment Scams

Wouldn’t it be great if you could get someone else to professionally invest and reap the huge crypto profits? This is the dream many subscribe to, including myself.

Two such cases which turned out to be complete ponzi schemes, just with slightly different crypto flavours were Bitconnect and Yield Nodes. Both platforms offered amazing returns, confident inspiring leadership teams, well advertised by prominent trusted figures and were operating for a decent amount of time.

Ultimately you need to refer back to the golden rule, there is no such thing as easy money and anyone guaranteeing you 50% APR (Annual percentage rate) returns is full of shit. The icing on the cake is when they say constantly defend themselves as being ‘not a scam’!

Whenever you see such a platform offering a ‘too good to be true’ return on your investment, you need to scream ‘BittttCooonnn-eeccccc-ttttttt’. They are either going to take all your money and disappear or given you valueless tokens you cannot convert.

15. Never forget the market is manipulated

Manipulated markets are a problem, and have recently become far worse as professional traders, hedge fund’s and ETF’s battle to make a profit.

Tactics you often see are:

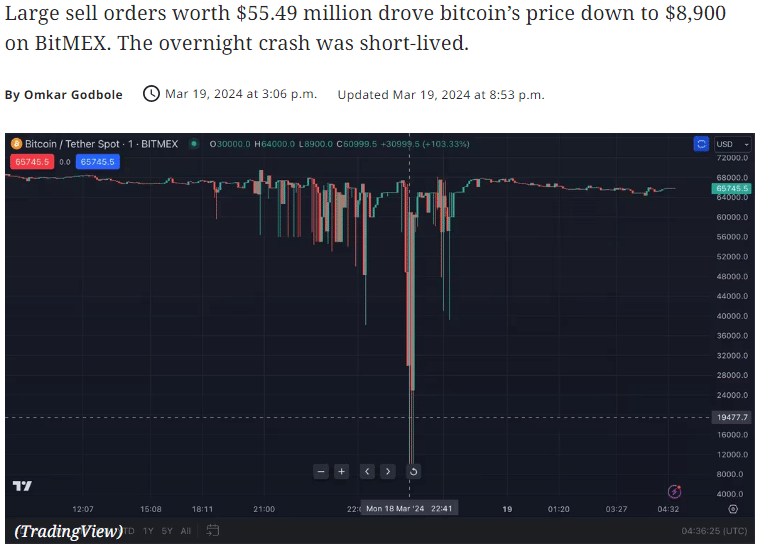

Flash Crash’s & Stop Hunting

Very large amounts of funds (billions) are injected and removed from the market to pump up or dump the market leading to liquidations or people hitting there stop losses. A recent example of this was a few days and covered on Coindesk where Bitcoin Flash Crashed to $8.9K on BitMEX.

It is common to see flash crashes wipe hundreds of millions of trades out in an instant, without a doubt this is deliberate. Also just as common and expected is other traders and possibly the exchanges ‘Stop Hunting’ bringing the price down of a token down to common price points where a trader might have set a stop loss, only for it to immediately bounce back.

Wash Trading

Traders, sometimes affiliated with the project or simply just big holders trade large amounts between themselves to artificially generate trade volume. This can give the appearance the token is about to take off and moon or is far bigger than it is.

Media & Social Manipulation, Paid New Articles

More and more are we seeing massive promotion and fud campaigns being orchestrated throughout the media at the highest levels, then the complete opposite happening days later seemingly to dump on retail markets.

It’s important to note that it is trivial to buy ‘Press Releases’ which mimic independent journalists for just only a couple of thousand and get you’re information posted in multiple high-profile places.

Another risk to be aware of is social influencers pushing their own ‘low market cap’ investments to a larger audience causing a significant gain for them. Remember to always do your own research and not buy the hype.

Exchanges competing against users

This is something you are going to learn the hard way and something you are going to have to see for yourself as it’s clearly tin foil hat material that I wouldn’t believe.

Many exchanges have their own investment products. Like in a game of poker, you don’t want other players or the dealer to see your cards however in the case of exchanges they know your stop losses, values of stop orders and where you will be liquidated at.

Over time you will see behaviours like your favourable buy/sell orders being skipped over while less favourable actions trigger instantly, price action like dips not being reflected on other markets or even other devices signed into other users!

Front Running & Insider Knowledge

Knowledge is power and sometimes those with power are just a little to quick to act.

Insider trading is both unethical and illegal in most parts of the world. It is not uncommon for smaller projects teams to buy significant numbers of tokens prior to major news such as an exchange listing and then dump the news back on its holders.

The lesser of the problems and still fair game are projects releasing important upcoming information about their projects on channels like Telegram to their holders to front run non subscribers finding out by more mainstream channels which could take several days. This is more of a make sure you follow your token closely if you are an investor or trade it.

In 2023 a brother of a former Coinbase product manager was jailed after using privileged insider information to buy upcoming tokens ahead of their listings. This was caught onto and well documented in the article Crypto exchanges tackle insider trading after recent convictions and highlights that this is an issue with very real consquences.

Pump & Dumps (Rug Pulls)

Rug pulls are tokens where the developer has only one intention of pumping the token up to a high price, and through a combination of either being a whale with a substantial number of tokens or delbrite technical vulnerability in the contract is able to with lkjhds;gdraw all the liquidity (money) out of the token in an instant.

This is normally an issue for brand-new projects with microcaps (sub 1million) but can affect any token.

Hallmarks of a rugpull are:

- Very new token

- Generic meme token name with no utility

- Team is not ‘doxxed’ (listed)

- No or minimal community

- Few holders

- No audits

- No or poor whitepaper: It should be at-least 20 pages and detailed

- Not listed on any credible exchanges

- Very large marketing campaign

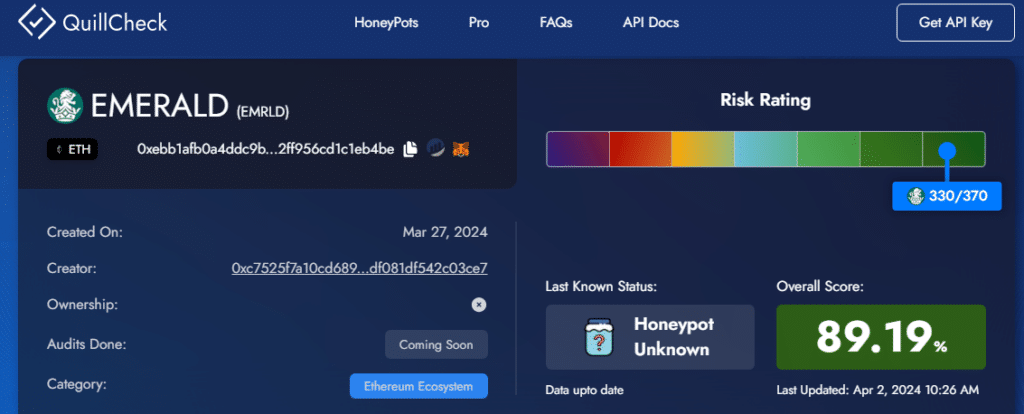

QuillCheck (Pictured Below) is a great free tool to summarise the key information about a token and look for the most obvious signs its a rug pull.

Not all rug-pulls are small, two rugs that caught many people off guard was Squid Game token whose creator ran off with over $3m and OneCoin for over $4b in a similar ponzi scheme as Bitconnect.

16. Remember to take profits

Sadly taking profits is something I was very bad at, why would I liquidate a valuable asset which is appreciating and compounding making me more profit!

When the price of crypto dropped, investments started suffering impermanent loss and the pretty big numbers on my trading screen did not improve my quality of life I knew I had a problem.

As a rule for every 3 dollars I make, I take one $1 and turn it into fiat. This still allows my initial crypto investments to grow, pay my bills and enjoy what I earned.

Many exchanges such as crypto.com and bybit offer debit-cards allowing you to pay for things online or withdraw cash from an ATM. This may be an option worth exploring however do be mindful of the associated fees.

17. Understand your tax obligations

Unfortunately as your not a large enterprise, celebrity or politician you may have quite substantial tax obligations, maybe even upto 50% of your profits!

World governments and financial institutions are investing considerable resources on cracking down on crypto-currency to match exchange accounts/wallets/transactions to a particular citizen. Many exchanges are now obligated to forward and link up your details when completing the KYC process.

It is strongly recommended before you start getting into crypto and certainly before liquidating an asset and withdrawing to first speak with an experienced accountant familiar with crypto-currency regulation in your country.

18. Self custody your savings over multiple wallets & exchanges

You’ve probably head ‘not your keys, not your crypto’, this is 100% spot on advice. Not having the crypto tokens under your direct control, if the exchange or platform gets hacked/shutdown/seized by authorities/is a scam you lose everything with minimal recourse.

By using a self-custody wallet, ideally a hardware wallet such as a Ledger or Trezor it is comparable to having the physical tokens in your control, like gold in the bank. It is strongly recommended you split up your balances over multiple wallets/devices in the off chance one of the devices is ever compromised.

It is critical that you have both a secure hardware ‘cold’ wallet for storage that remains offline in a safe place, and a separate ‘hot wallet’ like metamask or trustwallet used for more day-to-day transactions. This is as hot wallets that potentially need to connect to different services are at far higher risks of being compromised.

19. Keep your devices and wallets safe

- Never ever share your ‘seed phrase’ (24 word), with it anyone can access and move your funds!

No one will ask for this. Protect this document with your life and do not upload it online or even take a picture of it. - Your wallet does not ‘upgrading’ or ‘syncing’!

Do not listen to scammers on telegram or ever allow websites to connect up to your wallet. - Change your privacy settings on Telegram to restrict who can add you to a group

- Always verify information through the project’s official announcement channels

- Have a secure device for trading which is not shared with other people or used for other uses

- Avoid telling others that you have crypto as it can make you a target

- Always have 2FA on your online accounts (banking, exchanges, platforms) and have a separate email account for only crypto-related transactions.

20. Keep Your Emotions In Check

Keeping your emotions in check is one part of trading

FOMO (Fear of missing out)

Don’t buy the hype and skip your regular due diligence just because others are buying.

This just leads to taking disproportionate risks and in most cases if you are only hearing something because everyone else is talking about it, you are too late!

Greed

This one has caught me on several occasions on several occasions

- Expecting a token to climb higher than all the technicals and my own formulas would

- Entering into the market at the wrong time or with excessive margin or leverages

- Disregarding my own rules, strategies, trading plan and risk management to make a quick buck

- Not cutting my losses earlier enough out of denial I’m wrong or it will bounce

- Not taking profits and continuously reinvesting everything

Don’t chase losses

This is an emotional trait of traders which everyone who trades is guilty of at-least once.

- Doubling into a losing position

- Not cutting on your pre-defined stop loss

- Trading a market which doesn’t meet or even contradictory to your plans of strategies

While certainly not a movie about trading crypto, it’s the line “Let It Go” of putting the past and current situation behind you and moving on, it’s also a catchy song I message to people who ask me “What price do they think this losing trade will bounce on”. While cutting your losses will be terrible today, it allows you to play again tomorrow.

Disappointment and anger after a bad deal

You will lose significant amounts of money and trades. It sucks. No matter how you list it if it was a mistake, slow bleed out or flash crash in the market is always sucks. There is no easy way for me to say this but having a risk management strategy helps reduce the worse of this and allows you to start tomorrow fresh.

I’ve had trades that should have been an easy no-brainer where I broke my own rules (high lev, no stop loss) and came back minutes later to huge losses. You just have to cut your losses. Have a day off and vow never to do it again.

Know when to take a break

After a bad string of trades and significant losses, the best and only solution is to take a break from trading and allow your emotions to clear and not cloud your judgement.

The markets will still be there when you get back and it is the perfect opportunity to get into it again with a fresh mind and new ideas.

It’s great to enjoy something, but not let it consume you

Trading can quickly overwhelm your life with habits such as continuously checking your devices for the latest price moments and ruin your sleep cycle.

I don’t have much good advice on this one, but methods I employ are:

- Avoid leaving high-risk trades which require monitoring overnight or over the weekend

- Have clear working hours and don’t trade everyday, for example 4 days a week

- All my trading is done on a dedicated computer and phone

- Don’t talk about work after hours

21 . Learn from your mistakes and successes

There is nothing wrong with making mistakes from time to time, it’s making the same mistakes twice and not learning from them which is a problem. As you work through problems and find out what works and what does not you will become a better trader with valuable experience which will stick with you for life.

Ultimately mistakes are just expensive training!

Final Thoughts and Conclusions

I wish everyone who has got this far all the best in their journey and that they can take away something from this. Trading is not easy but can be a rewarding endeavour if you stick with it. This article is not a comprehensive list of how to get into trading, but only some of the lessons I wish had paid attention to.

You will have up days, down days and days you wish you wish that never happened.

Start slow, pay attention to advice and have a plan. Those who are passionate and resilient will succeed

Please feel welcome to leave a your feedback in the comments below