Diversifying Wealth During Troubling Times

When times are tough and during political turbulence, it’s essential to know your wealth created through years of blood, sweat and tears is safe. This has never been more relevant where we are experiencing never-before-seen power grabs against civil liberties by global governments, collapses of once great cities and a looming economic crash fueled by a rapidly increasing cost of living

Traditionally the definition and financial advice of ‘diversifying’ your portfolio consisted of investing into Index Funds instead of trading individual stocks, holding government bonds, keeping cash in accounts, and to some extent holding real estate. But is this really enough during times of unrest and what risks do each carry?

Diversifying Stocks

Not going all in on only a small handful of companies is wise in dynamic and bearish markets. While the potential return on an index fund such as ‘S&P 500’ is lower, your risk is spread over a wider range of companies and sectors. One of the largest risks is having highly correlated investments that react to the same event, be it natural or man-made.

While individual companies fail and sectors can slow down, it’s unlikely foreseeable events like invasive pests, sanctions, broken supply chain and poor government policy will affect the entire market.

Holding Cash

Without question keeping your wealth locked up in a bank vault is often regarded as the safest form of storing wealth however it does have its dangers.

Inflation is the biggest killer when it comes to holding fiat money long-term, be it keeping £100 in your wallet or £1m of your life savings in a savings account. When interest rates are below inflation rates you are literally throwing money away and it’s losing buying power. A simple example of inflation in our daily lives is a 1L bottle of milk going up from £1 to £2, while you haven’t lost money the money itself has lost buying power leading to the same outcome. While a 100% increase for a good in a single year is extreme, the eye-watering cost of energy in the UK shows it is possible.

It’s important to remember that Inflation doesn’t need to be ‘hyper’ (over 50% per month) to be problematic. Inflation is compounding and even over 5 years can really add up.

As our broke governments try to get a handle on the mess they’ve created they are eagerly looking for creative ways to raise revenues. Well-stocked bank accounts are a prime target with 2022 showing us that Western governments such as Canada’s are willing to seize both personal and business accounts under emergency orders without a court order for something as little as sending $50 to an organisation! With times getting tougher it’s not hard to get on the wrong side of the government.

Canadian trucker Derek Brouwer told Fox News that along with his truck being seized, his personal and business bank accounts have been frozen

Fox News (21 February, 2022)

One thing to be careful of is ensuring your account doesn’t become ‘dormant’ and seized after a period of inactivity. These periods can vary between 15 years in the UK to as little as 3 years. In most cases this is still recoverable however can be a slow time-consuming process.

Surprising for some, banks do not hold a great deal of liquid cash (reserves) and in many parts of the world such as Europe and the United States do not have to hold reserves at all. This can quickly lead to issues during economic uncertainty where a major event could trigger a bank run and lead to extreme withdrawal restrictions or the bank becoming insolvent when customers try to withdraw their money.

The Great Depression demonstrated how catastrophic this can be and the cascading nature of banking disaster. In the years following the Black Tuesday wall street crash over 9000 banks folded leading to millions of Americans from all walks of life losing their savings. Safeguards have been put in place over the decades to instil trust in the banking system, however the 2012–2013 Cypriot financial crisis where bank deposits above €100,000 were seized to help pay for an international bailout shows the system is not infallible. Should a large-scale banking crisis occur it’s unlikely the government would or could bail everyone out. The 2008 Financial crisis reminded us that the banking sector has not learnt lessons from the past and can hold beliefs they are ‘too big to fail’.

Gold & Precious Metals

Holding precious metals have been a durable long-term store of wealth for millennia and should be part of every portfolio during uncertain times. It’s important to note that gold for the most part is not an income-generating asset and neither earns interest nor pays out dividends.

Precious metals can present issues when trying to liquidate them for cash on short notice. This is being seen in Turkey where brokers are offering well below market rates to exchange gold bullion for the plunging Turkish lira due to the high local supply of gold.

The biggest elephant in the room which often gets bought up when holding gold is the possibility of governments seizing gold from investors. Most notable was executive order 6102 “forbidding the hoarding of gold coin, gold bullion, and gold certificates” introduced by US President Franklin D. Roosevelt in 1933 where gold was purchased back at a fixed and arguably low value. Similar legislation have arisen during economic crises such as part of the ‘Australian Banking Act in 1959, allowing gold seizures of private citizens if the Governor determined it was “expedient so to do, for the protection of the currency or of the public credit of the Commonwealth.‘

The takeaway from these risks being gold should not be your primary way of liquidating assets for cash and that you should have self-custody of the physical gold.

Real Estate

Owning land is typically a safe investment over the medium term, unlike cash or company stocks is very hard for more to be printed and for many property types will consistently demand as populations still need somewhere to work and live.

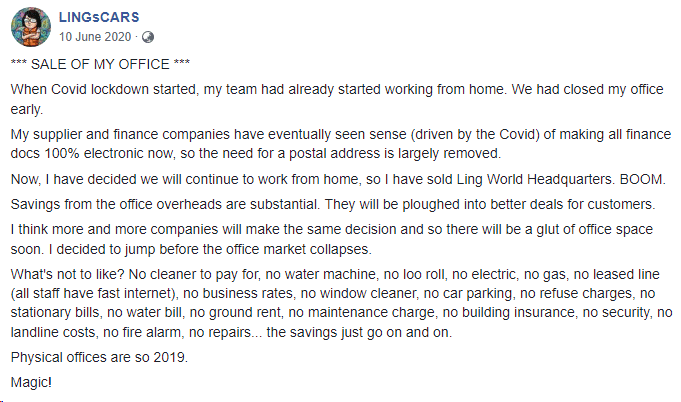

COVID has shown the rights of landlords are secondary in times of unrest where many renters around the world were given eviction moratoriums where they could not be evicted even if they refused to pay rent. In some cases this resulted in landlords needing to bail out the renters instead of the government and end up homeless themselves.

Commercial real estate was not spared either with many cities mandating ‘working from home’ restrictions, density limits and lockdowns forcing valuable office space to remain empty. This government interference has led to companies to reevaluate the value in commercial real estate.

Investors of both commercial and residential real estate need to ensure they are not within a bubble which is about to pop. This was seen with tragic outcomes during the 2008 Housing Crash where a red hot market fueled by low-interest rates and subprime lending lead ultimately lead to mass defaults and housing prices crashing due to the oversupply of properties on the market.

Crypto Currency

New to investment portfolios as a perceived store of wealth are cryptocurrencies, primary Bitcoin and Etherium. It goes without saying that cryptocurrencies are extremely high-risk and speculative however does have interesting qualities.

Unlike the traditional banking and financial system, it is impossible for governments and institutions to impose trading restrictions or halt trading in times of major price action such as with a ‘bank holiday’ allowing for wealth to be moved across jurisdictions at any time in seconds. This is in part thanks to its decentralised transaction processing, on-chain decentralized Exchanges and ability to hold the tokens in a non-custodial wallet you control.

It goes without saying that if you hold any significant amount of cryptocurrency it should not be held on an exchange but rather in a hardware wallet such as a Ledger X or Trezor T with the Seed Phrase securely stored elsewhere. At the best of times centralised exchanges such as Binance and Coinbase struggle in volatile periods either by design or symptoms of a panicked market.

Realistically it should be expected that in times of major financial distress that cryptocurrencies will plummet and ‘stable coins’ like USDT may not be immune and get depegged of the dollar.

Like with the share market you should be careful not to put all your eggs in one basket on one particular token and wallet address.

Hard Assets

Similar to gold ‘hard assets’ with tangible purpose can hold their value and even increase in a down-turn, particularly if shortages result. These can include:

- Construction and agricultural equipment

- Specialist and high-quality tools

- Art-work from well-known artists

- Rare & Collectable Spirits

Digital Assets

With most of the population spending just as much time online as they do outside digital assets can be equally as valuable hard physical assets. These can include:

- High-value domain names

- E-Learning and training content

- Established blogs and websites, particularly cash-positive e-commerce sites

- Online established business and systems

Summary

If the prophecies are true that we are in the precursors of a large economic event there will be few winners in this and there is no escaping substantial losses. By spreading wealth across different classes the chances are far reduced that you’ll be left with nothing to your name as was seen in past major recessions and depressions.

How are you protecting your wealth, let us know in the comments below?