How To Save Money In Difficult Times

The current state of the world has brought about unprecedented financial hardships for many. In these difficult times, it is more important than ever to save and conserve money in order to ensure a secure financial future. Fortunately, there are plenty of ways to save money no matter what current events that can make a significant difference. This article will cover some of the best ways to manage your finances and save money even in difficult times.

Difficult Times

The last few years have been exceptionally challenging, few could have foreseen the physical, emotional, and economic devastation that covid and our leaders unleashed upon our lives and plans. Sadly, we are not out of the woods and our politicians are still creating are focused on starting new conflicts over the world instead of cleaning up after the mess they made.

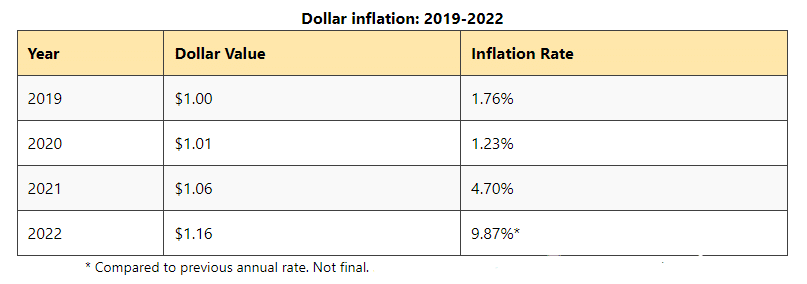

Unfortunately the reality is the buying power of the dollar has dropped over 16% since the beginning of the pandemic with $1.00 in 2019 now only worth $0.84 in 2022. Despite what the red-faced guilty politicians may try to imply, inflation is not and could never have been ‘transitory’ after pumping several trillions of dollars into the economy.

Making the cost of living crisis matters worse is the self-made global ‘green’ agenda to which has led to electricity shortages as a result of closing power stations and the deliberate destruction of the Russian Nordstream pipelines by the West that provided 40 per cent of Europe’s total energy requirements.

These increased energy costs are a major contributor in creating a feedback loop which further pushes up the cost of prices of all goods, including food processing and costs of services. Stagnant wage growth which is not keeping up with inflation is leading to many being unable to make ends meet, let alone save money or afford luxuries.

The short answer is things are unlikely to improve in the short-term and medium term.

Budgeting Basics: Know Your Income, Track Spending, Cut Nonessential Expenses

Creating a budget is an effective way to manage your money and provide an in-depth look at where your money is going so that you can make smart decisions about how to spend it.

Step 1: Create a Savings Goal

Living within a tight budget requires sacrifice and works best when the financial goal is meaningful. This could be a range of things including a nice holiday, new car or even a wedding

Step 2: Print out your credit and debit card bills for one month

Create a table of all your expenses for month, a good way to do this is by printing out your bank statement.

Once you have this information compiled, divide your expenses into categories such as housing, utilities, insurance, transportation, entertainment and food. Once-off purchases can be excluded.

Step 3: Figure out how much income you’re bringing in each month after tax

Once you have calculated your expenses, you will next need to determine your regular ‘net earnings’ (after-tax take-home pay) for the month. This is best done once you have calculated expenses!

If your wages are unpredictable create an estimate and aim for a lower conservative amount instead of an ambitiously high figure. It’s always better to be surprised and end up with more money than fall short.

Step 4: Cut Nonessential Expenses

With a highlighter, take a hard look line by line and start crossing through items that can be cut out. Examples of common non-essential discretionary spending include:

- Streaming Services: Spotify, Netflix, Disney+, Youtube Premium

- Unused Subscription Services: iCloud, VPN’s, Dating Apps, Games, Amazon Prime, Gym’s

- Fast Food: Takeaway Coffee, bottled water, restaurants, UberEats

- Reduce alcohol and Tobacco consumption

Step 5: Tally up your cuts

If your expenses are lower than your wage means you expect to live BENEATH your means.

If your expenses are similar to your wage means you expect to live WITHIN your means.

If your expenses are above to your wage means you expect to live ABOVE or BEYOND your means.

Ideally you want to expenses to be less than 80% of your wages which allows for you to save 20% of your income towards your goals.

If your expenses are above this you really need to find ways to further reduce expenses or increase your income by either getting a wage increase or picking up additional work.

Upskill Yourself

Instead of going to the movies or starting an expensive hobby. Consider investing in yourself and learning a new marketable skill.

There are many online courses which can assist you break into a new industry or a be a desirable skill to complement your existing position. Further learning is a great factor in negotiating a wage increase or new role higher paying role within a company.

Research Cheaper Alternatives

Pay for the product, not the brand-name!

Buying cheaper alternatives to brand names can be a great way to save money. This is particularly true for products that have been around for some time and are not likely to change much in the near future. Cheaper alternatives can often provide the same or similar product quality as their more expensive counterparts, while costing significantly less.

Many times these low-cost items will also last just as long as their more expensive counterparts and in some places come from the same factory but just in different packaging, making them an ideal choice for budget shoppers. If you’re looking for something specific and don’t care too much about brand recognition, these low-cost options may be exactly what you need.

If you do want a certain brand name, consider buying it second-hand and looking in charity shops!

Another cheaper alternative is instead of eating out for lunch, make your own lunches. If possible consider meal-prepping and buying in bulk.

Look For Better Deal and Take Advantage of Discounts

Companies pray on you just paying the renewal. Every couple of years be sure to shop around to ensure your not getting ripped off.

- Read the junkmail and look out for specials

- Get a second quote for your insurance and compare it to your current policy. Give your current company a call and push them to see if you can get a better rate or to match the competition if cheaper

- Are you paying bank fees or interest?

Compare the market and see if it’s worth refinancing debt or if there are better plans - Are you paying to much for energy? There are many free tools that will automatically check to see if there is a cheaper provider if you upload your utility bill

- Call up your telecommunication provider and ask if there is a cheaper more suitable plan for your mobile and internet. Compare it with other providers and don’t be scared to switch, you can keep the same number and with e-sim the transfer is mostly painless.

Reduce Bad Debit

Paying off debit and liabilities is one of the best ways to reduce your repayments, improve your mental health and start saving again.

There are 2 main methods for paying back debt, the traditional ‘avalanche’ method where you pay off the highest interest debt first and the ‘Snowball’ method where you aim to pay off the most debts regardless of interest for a quick psychological win. Where possible ‘Avalanch’ is better.

You will still need pay the minimum amount for each loan regardless of what method you choose

| Debt Avalanche | Debt Snowball |

|---|---|

| Pay off debt with the highest interest rate first | Pay off debt from smallest to largest amount regardless of interest rate |

| Mathematically the fastest way to pay off the debt | Allows you to pay off smaller debts first, leading to quick wins that can help build momentum and confidence. |

| Can take a very long time to see results as you don’t see results for a long time | After several bills are paid you may begin to see the light at the end of the tunnel |

| Requires Discipline to avoid giving up | May leave debts with higher interest rates unpaid for too long, resulting in large payments when they are addressed later in the repayment plan schedule. |

Conclusion: Making the Most of Difficult Times

While these difficult times can be overwhelming; With the right perspective, it is possible to make the most of them. By creating a plan to stay organized, reframing negative thoughts, investing in ourselves and practising self-care, we can make a positive out of a difficult situation. It is important to remember that this too will pass and there will be prosperous times ahead.